Factors driving Car insurance rates are rising again, and many drivers are feeling the squeeze. With premiums expected to jump by an average of 7.5% in 2025, understanding the factors behind these increases isn’t just helpful—it can save you money. From inflation to changing insurance regulations, several key elements are driving up costs. This article breaks down 4 factors driving car insurance rates right now, so you can take steps to protect your wallet while staying covered.

Economic Pressures: How Inflation Impacts Insurance Costs

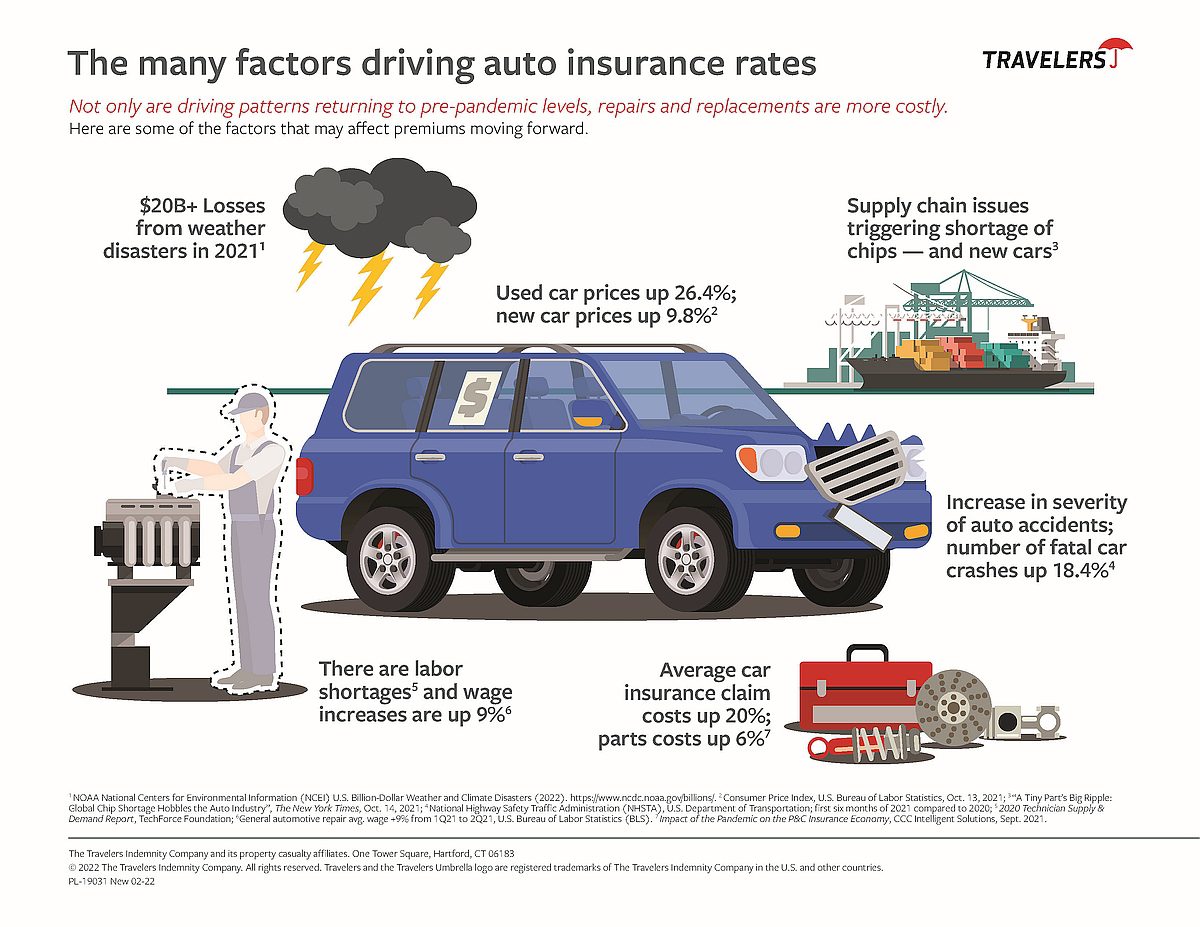

The rising tide of inflation doesn’t just affect your grocery bill—it also has a direct impact on car insurance rates. From skyrocketing repair costs to global supply chain disruptions, auto insurers are facing serious challenges. Here’s how these economic pressures are reshaping your premiums.

Repair and Replacement Costs

Inflation has sent the costs of vehicle parts soaring. That small fender bender? It costs a lot more to fix than it did a few years ago. With the scarcity of essential components like microchips, automakers and repair shops are facing extended waiting times and higher prices. Naturally, this increases the expense of claims, which insurance companies must pass along to policyholders in the form of higher premiums.

When repairs that used to take a week now stretch into months, it becomes a costly affair—especially when rental cars or alternate arrangements come into play. It’s not just about price hikes; it’s about ratios. Insurers need to maintain a certain balance between incoming premiums and outgoing claims costs, and inflation is tipping that scale unfavorably.

Impact of Supply Chain Issues

The global supply chain? It’s a mess. With delays and shortages in everything from tires to advanced car sensors, the cost of replacement parts has surged almost dramatically. According to Harvard Business Review, the ripple effects of disrupted supplier networks mean longer shipping times, inconsistent factory outputs, and price fluctuations for raw materials. What does this mean for you? Higher repair bills—and inevitably, higher insurance rates, these are factors driving car insurance rates.

For example, manufacturers who previously shipped in bulk now face smaller, costlier shipments due to bottlenecks at logistics hubs. Anything impacting an industry as globalized as automotive production has wide-reaching effects, and insurance providers often absorb these unexpected costs, eventually passing them along to consumers.

Rising Labor Expenses

In addition to materials, labor costs in the auto repair and manufacturing sector are spiking. Skilled workers demand—and deserve—competitive wages, but this adds to the overall expense of vehicle repairs. According to Liberty Mutual, when auto repair labor expenses climb, insurance companies feel it in their cost-per-claim metrics.

Think of it like a car wash—what used to cost $10 today might cost $15 due to higher wages and operating costs. Scale that up to fixing a damaged engine or replacing a Tesla battery, and it’s easy to see how repair shop bills are pushing up the cost of insurance claims. The result? Insurers are compelled to raise premiums.

By understanding how inflation, supply chain woes, and labor expenses connect to your insurance rate, you’re not just informed—you’re prepared. These economic shifts are here to stay for now, but knowing their impact helps you make smarter choices about your policy.

Geography and Climate Risks

When it comes to factors driving car insurance rates, where you live matters. Your geographical location not only defines the environment and potential driving hazards but also determines the frequency and severity of natural disasters, population density, and accident risks—key factors that insurance companies analyze when setting premiums. Let’s break down how these geographic and climate elements play a critical role in factors driving car insurance rates..

Impact of Natural Disasters

In recent years, climate-related events such as hurricanes, wildfires, floods, and even hailstorms have been occurring more frequently and with greater intensity. These events have a direct impact on car insurance rates. Why? Because insurance providers need to cover the skyrocketing costs associated with claims resulting from climate catastrophes.

Whether it’s vehicles damaged by floodwaters in Florida or hail-dented cars in Colorado, natural disasters cause an undeniable spike in insurance claims. This higher volume of claims drives up costs for insurers, who then reflect these costs in increased premiums for affected regions. For instance, NPR states that home and auto insurance premiums are climbing as extreme weather takes its toll, creating an upward trend in rates even outside of disaster zones.

Insurance companies also analyze future risk projections when pricing policies. If you live in an area prone to hurricanes or wildfires, you’re likely paying more for coverage. These risks aren’t always seasonal—you might be startled to learn that even non-traditional disaster areas are experiencing record weather changes due to shifting climate patterns. Learn more from Salt Jacket about how severe weather impacts auto insurance costs.

Population Density and Accident Rates

It probably won’t surprise you that where people live impacts the likelihood of accidents. Insurers factor in population density when determining car insurance rates. Urban areas, with their crowded streets, higher traffic volumes, and increased chances of collisions, typically see higher premiums compared to their rural counterparts.

Picture a bustling city square: traffic jams during rush hour, close quarters among vehicles, and limited parking spaces. All these elements make urban accidents more likely. Additionally, urban regions often face higher rates of car theft and vandalism, which further inflates premiums. Conversely, rural areas may feature quieter roads and fewer vehicles, reducing accident claims and keeping insurance costs lower. This guide from Appletree Insurance explains how location-based variables influence your premiums.

That said, rural areas have their share of risks too. Speeding and wildlife collisions are more common on remote highways, leading to costly claims for policyholders. Insurers balance these risks differently based on the vehicle density and claim statistics from your ZIP code. In fact, Bankrate highlights how population density contributes to regional variations in car insurance pricing.

Whether you’re navigating your daily commute in the city or cruising through wide-open country roads, your environment shapes your potential liability. It’s worth nothing that even subtle differences—like living on the border of a high-traffic city—can make a noticeable impact on your insurance costs.